You are now leaving the Strong Valley Wealth & Pension, LLC ("Strong Valley") website. By clicking on the "Schwab Alliance Access" link below you will be entering the Charles Schwab & Co., Inc. (“Schwab”) Website. Schwab is a registered broker-dealer, and is not affiliated with Strong Valley or any advisor(s) whose name(s) appears on this Website. Strong Valley is/are independently owned and operated. Schwab neither endorses nor recommends Strong Valley. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Strong Valley under which Schwab provides Strong Valley with services related to your account. Schwab does not review the Strong Valley website(s), and makes no representation regarding the content of the Website(s). The information contained in the Strong Valley website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

What is happening with the latest economic data? Both the hard and soft data have been softening. Do you know the difference? What does this mean for our economic outlook at home? Let’s take a look at the GDP, inflation and durable goods, as well as consumer sentiment.

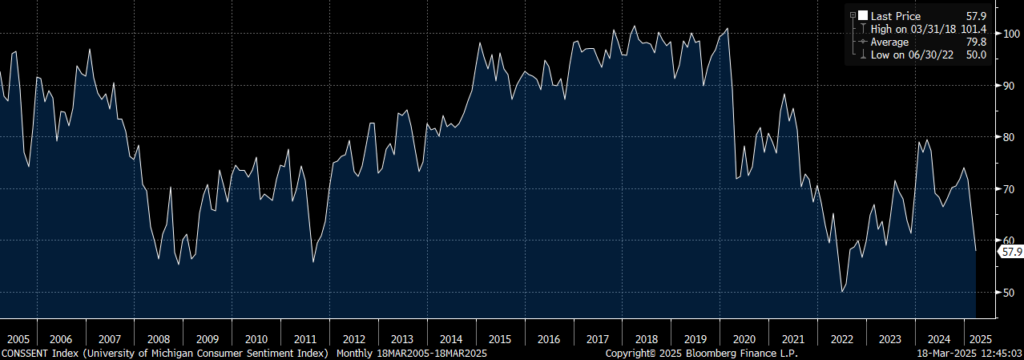

What's your preference, hard or soft? No, not ice cream…data. Economic data, to be more specific. Hard data tends to look at things like GDP, inflation, and durable goods, while soft data looks at surveys of how consumers and investors are feeling. There has been some softening in the most recent hard data related to the U.S. economy. The soft data has declined more, as evidenced by the the Conssent Index, from the University of Michigan Survey of Consumer Sentiment, which has reached recessionary levels.

Conssent Index

University of Michigan

Survey of Consumer Sentiment

The directionality of both types of data confirms an apparent softening in U.S. economic momentum, likely due to the increased uncertainty in the minds of investors and consumers, ahead of tariffs and their potential impact on inflation and earnings. However, the divergence in the magnitude of the two types of data indicates potential opportunities in the market, where sentiment has become too negative relative to the hard data being reported.

The U.S. economy remains stable, with low unemployment and expectations of robust earnings growth in 2025 and beyond. Key to watch going forward will be how the divergence of the two data types converge… soft data improving or hard data deteriorating. Watch for new reports on consumer confidence, as well as the University of Michigan’s consumer sentiment.

Another key data point to consider is the 1-year and 5-10 year inflation expectations from the University of Michigan. There has been a noticeable up-tick in short and longer-term inflation expectations ahead of tariff implementation. Further increases in inflation expectations may make future interest rate cuts more difficult. Simultaneously, bottoms in consumer confidence have historically represented very good buying opportunities in equity markets, as markets appreciate on the back of improving consumer confidence and sentiment.

WHAT HAPPENED

U.S. Rates - The Federal Reserve held rates steady and offered an outlook with slightly higher inflation forecasts and lower growth forecasts in 2025.

U.S. Retail Sales - Retail sales for February came in at 0.2% vs. estimates of 0.6% on a MoM basis, while Retail Sales Ex Autos & Gas came in at 0.5% vs. estimates of 0.4% on a MoM basis.

European Defense – The German parliament approved significant defense spending in support of Ukraine and European defense.