You are now leaving the Strong Valley Wealth & Pension, LLC ("Strong Valley") website. By clicking on the "Schwab Alliance Access" link below you will be entering the Charles Schwab & Co., Inc. (“Schwab”) Website. Schwab is a registered broker-dealer, and is not affiliated with Strong Valley or any advisor(s) whose name(s) appears on this Website. Strong Valley is/are independently owned and operated. Schwab neither endorses nor recommends Strong Valley. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Strong Valley under which Schwab provides Strong Valley with services related to your account. Schwab does not review the Strong Valley website(s), and makes no representation regarding the content of the Website(s). The information contained in the Strong Valley website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

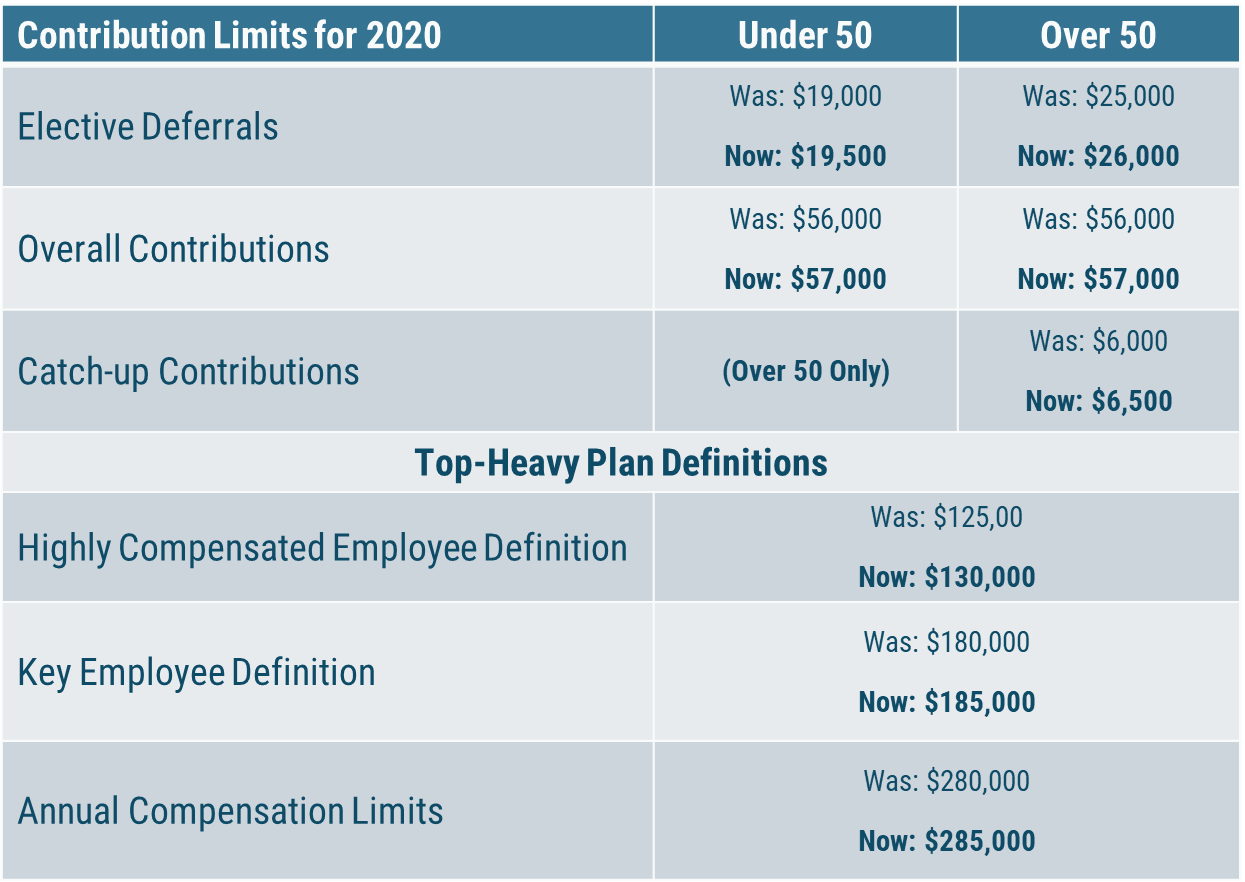

The “In Brief” bullet points cover just some of the highlights about the new compensation limits. There are other factors and regulations that may impact how these new limits apply to you specifically. Some of the factors include whether your compensation plan might fall under the “key employee” definition, or if you are a highly compensated employee. Your marital status, or the recent death of a spouse, and several other life situations may also impact your contribution limits, or at the very least potentially impact your savings strategy.

Most employees should probably be taking advantage of employer matching funds, and the amount that you choose to invest is called your elective deferrals – it does not include any contributions that your employer makes as part of the matching benefit (or even outside of the matching benefit). Essentially any contributions made on your behalf by your employer would be non-elective. The overall contributions would include both elective and non-elective contributions.

Of course, how much you should invest in your employee retirement benefit plan should be determined by creating an overall retirement strategy, and that may include additional investment and savings strategies to meet your specific financial goals and needs.

We provided the link to the IRS information for the sake of completeness and for reference, but the government has managed to pack a significant amount of complexity into a relatively short document. Strong Valley clients should contact us directly to discuss how the new limits apply in your specific situation, and in the context of your retirement strategy.