You are now leaving the Strong Valley Wealth & Pension, LLC ("Strong Valley") website. By clicking on the "Schwab Alliance Access" link below you will be entering the Charles Schwab & Co., Inc. (“Schwab”) Website. Schwab is a registered broker-dealer, and is not affiliated with Strong Valley or any advisor(s) whose name(s) appears on this Website. Strong Valley is/are independently owned and operated. Schwab neither endorses nor recommends Strong Valley. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Strong Valley under which Schwab provides Strong Valley with services related to your account. Schwab does not review the Strong Valley website(s), and makes no representation regarding the content of the Website(s). The information contained in the Strong Valley website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

What should consumers and investors expect beyond March 2022? The oil market has been uncertain for several reasons. This article looks into factors that affect the price of oil, resulting in gasoline price changes. Add to that all of the products beyond the pump that contain crude oil and you get a better picture of how the cost of energy affects virtually every aspect of the economy.

The stock market in 2022 has seen large declines, beginning with a January drop, followed by a down February, and so far a declining March. Naturally, this volatility makes investors nervous.

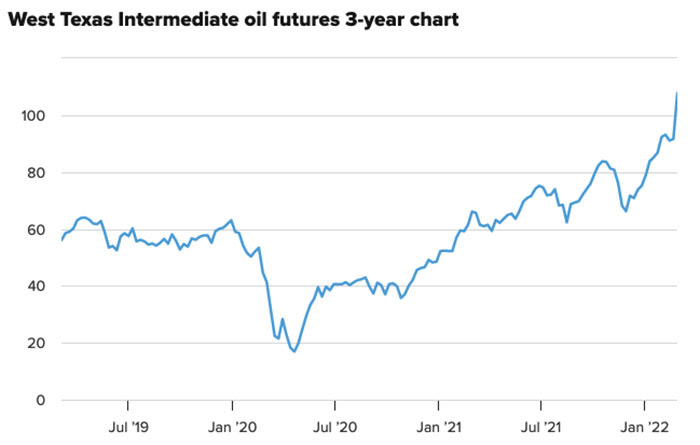

At the center of this volatility has been the price of oil. Oil prices skyrocketed over 50% in 2021 and in the first week of March, leapt a staggering 25% in a single week (the week ended Friday, March 4th).

Consumers and businesses are spending more money on fuel, which drives inflation (cost to get goods to places has to be covered by someone). On the flip side, energy companies are making more money when oil prices rise (Marathon Oil is up over 92% over the past year).

What should consumers and investors expect?

As we have all seen, gas costs a lot less than it did a year ago. In March of 2021, a gallon of gas in the U.S. cost about $2.70. We’re seeing that same gallon of gas cost over $4.00! Remember back when filling your car’s tank cost over $35?

Will the price of oil and gas stay higher than it was last year or will it continue to rise?

Why does the price of oil change so much? The price of oil is affected by so many factors and so many uncertainties. Oil supplies are down, but demand has risen dramatically, so prices are higher. The weather, transportation costs (via ship, truck, pipeline, etc.), and taxes also play a big role in oil prices.

The oil market has been uncertain for several reasons. For one, the U.S. is producing less oil, due to a change in our political landscape. International factors also influence the price. Oil producers have been concerned about the health of the massive Chinese economy, with its high oil demand. Strife in the Middle East, with ISIS, the Syrian war, and conflict in Iraq, among other things, has caused uncertainty. And now Russia has invaded Ukraine.

In a more practical sense, how does the price of oil affect the cost of gasoline? Pretty directly. Any change in the price of a barrel of oil directly affects the price of a gallon of gas.

Barrel of oil. A barrel of crude oil holds 42 gallons. From this barrel will come about 12 gallons of diesel fuel, 4 gallons of jet fuel, and smaller amounts of propane, asphalt, motor oil, and various lubricants, along with about 19 gallons of gasoline. So it takes a barrel of oil, on average, to come up with about 1.5 tankfuls of gas in your average, non-diesel car.

Considering all the oil products, each person in the U.S. consumes an average of about 2.5 gallons of crude oil per day, according to the Department of Energy. As a result, the price of a barrel of oil affects each us beyond the pump, too.

The price of oil has been a major economic factor for years. The cost of energy affects virtually every aspect of the economy and the market, including our investments.

The supply of oil will eventually increase, especially as new producers come online and oil-producing countries change their plans.

Your financial advisor will monitor all of these developments and is best source for information about their effect on your investments.