You are now leaving the Strong Valley Wealth & Pension, LLC ("Strong Valley") website. By clicking on the "Schwab Alliance Access" link below you will be entering the Charles Schwab & Co., Inc. (“Schwab”) Website. Schwab is a registered broker-dealer, and is not affiliated with Strong Valley or any advisor(s) whose name(s) appears on this Website. Strong Valley is/are independently owned and operated. Schwab neither endorses nor recommends Strong Valley. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Strong Valley under which Schwab provides Strong Valley with services related to your account. Schwab does not review the Strong Valley website(s), and makes no representation regarding the content of the Website(s). The information contained in the Strong Valley website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

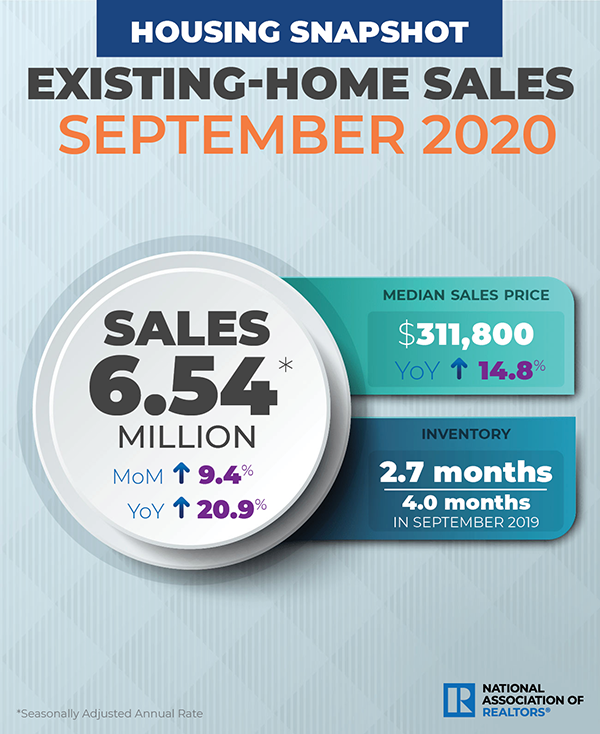

According to the National Association of Realtors, existing-home sales grew for the fourth consecutive month in September as each major region saw month-over-month and year-over-year gains, with the Northeast seeing the biggest jumps.

Sometimes, when most people believe the same thing, a big change is on the way. That thinking is known as contrarian. The housing market may be primed to give us a big lesson in contrarianism. If so, that’s not-so-good news for homeowners and real estate investors.

Contrarian theories abound concerning the herd mentality of investors. You could argue it was as much of a death note for the market as for an athlete featured on the cover of Sports Illustrated.

We are not too terribly worried when we see only one article of this nature. But when the topic appears in many news articles, it is a potential red flag, although not a guarantee that anything will happen. The psychology of the cover curse is that, by the time something is the conventional wisdom and graces magazine covers, it has peaked.

The same contrarian thinking could be applied to the housing market, which by all accounts is sizzling in 2020.

According to the National Association of Realtors, existing-home sales grew for the fourth consecutive month in September as each major region saw month-over-month and year-over-year gains, with the Northeast seeing the biggest jumps.

Here are a few highlights:

The highlights above paint a robust picture of today’s housing market and whether we’re headed for – or are already in the midst of – a bubble is really anyone’s guess. Unfortunately, we usually don’t see a bubble until it has already popped.

But consider some of the other statistics from the NAR:

Remember the “Location, Location, Location” mantra preached by realtors everywhere? Well, look at what the four major regions in the U.S. have experienced:

While home prices continue to soar, interest rates are at historical lows and inventory is tight, remember when someone says: “this time it’s different.”

Because nothing goes up forever.