You are now leaving the Strong Valley Wealth & Pension, LLC ("Strong Valley") website. By clicking on the "Schwab Alliance Access" link below you will be entering the Charles Schwab & Co., Inc. (“Schwab”) Website. Schwab is a registered broker-dealer, and is not affiliated with Strong Valley or any advisor(s) whose name(s) appears on this Website. Strong Valley is/are independently owned and operated. Schwab neither endorses nor recommends Strong Valley. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Strong Valley under which Schwab provides Strong Valley with services related to your account. Schwab does not review the Strong Valley website(s), and makes no representation regarding the content of the Website(s). The information contained in the Strong Valley website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

Bear markets happen. Bull markets happen. Just stick to your financial plan, and stay calm and disciplined. When the market sours or slumps, don’t believe talk that this time it is different. It is not.

History shows this is true. Here is a simple chart of the performance of NASDAQ for the 20-years ending March 7, 2022 (NASDAQ officially entered bear market territory on this day). This covers the decline and recovery from the last U.S. recession as well as the last bear market (the COVID-bear).

NASDAQ Over 20-Years

What does this chart show? When markets decline, they do so rapidly and painfully. The subsequent recovery is slow and uneven.

But it does inevitably happen. If you take the longer 20-year view of this chart, it’s clear that markets grow past previous highs after a dip.

Although the S&P 500 is not yet in a bear market, since it is “only” off 12% YTD and a bear market is defined as being off at least 20%, let’s examine historical bear markets as measured by the S&P 500.

There have been 26 bear markets and 27 bull markets in the S&P 500 Index since 1928. In addition:

Think you can figure out when the market is turning – either up or down and trade accordingly? Well, before you think that you should get out of the market now and wait this bear out, consider this:

In other words, the best way to weather a downturn could be to stay invested since it’s difficult to time the market’s recovery.

There are no investment strategies that give you the market’s ups and help you avoid the downs, save for luck. Fear and greed are irrational emotions that easily lead to bankruptcy if they influence your investment decisions.

Of course, it is hard to stay patient and hold when Wall Street analysts, investment gurus and financial TV pundits spout endless gloom and doom at the troughs and exuberant optimism at market peaks. Short-term thinking like this only guides you to do the wrong things at the wrong time.

This is why it helps to work with an advisor – someone to cool your head when irrational exuberance strikes, and convince you to stick to your plan in the face of uncertainty.

Although it can be difficult to watch your portfolio dip with the market, it’s important to keep in mind that downturns have always been a temporary part of the process.

No matter what the markets are doing, assure yourself that this time is not different.

The stock market in 2022 has seen large declines, beginning with a January drop, followed by a down February, and so far a declining March. Naturally, this volatility makes investors nervous.

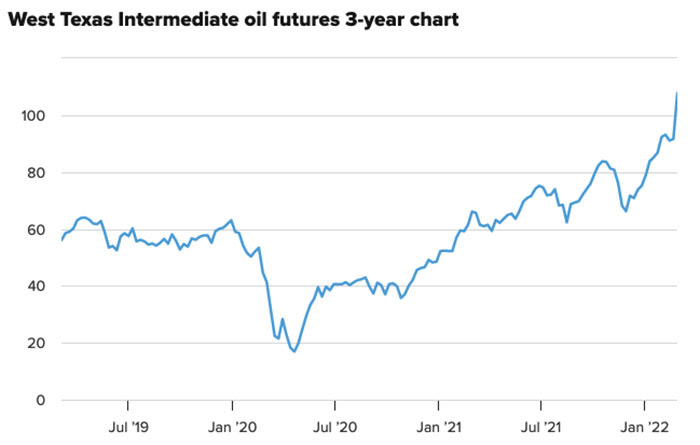

At the center of this volatility has been the price of oil. Oil prices skyrocketed over 50% in 2021 and in the first week of March, leapt a staggering 25% in a single week (the week ended Friday, March 4th).

Consumers and businesses are spending more money on fuel, which drives inflation (cost to get goods to places has to be covered by someone). On the flip side, energy companies are making more money when oil prices rise (Marathon Oil is up over 92% over the past year).

What should consumers and investors expect?

As we have all seen, gas costs a lot less than it did a year ago. In March of 2021, a gallon of gas in the U.S. cost about $2.70. We’re seeing that same gallon of gas cost over $4.00! Remember back when filling your car’s tank cost over $35?

Will the price of oil and gas stay higher than it was last year or will it continue to rise?

Why does the price of oil change so much? The price of oil is affected by so many factors and so many uncertainties. Oil supplies are down, but demand has risen dramatically, so prices are higher. The weather, transportation costs (via ship, truck, pipeline, etc.), and taxes also play a big role in oil prices.

The oil market has been uncertain for several reasons. For one, the U.S. is producing less oil, due to a change in our political landscape. International factors also influence the price. Oil producers have been concerned about the health of the massive Chinese economy, with its high oil demand. Strife in the Middle East, with ISIS, the Syrian war, and conflict in Iraq, among other things, has caused uncertainty. And now Russia has invaded Ukraine.

In a more practical sense, how does the price of oil affect the cost of gasoline? Pretty directly. Any change in the price of a barrel of oil directly affects the price of a gallon of gas.

Barrel of oil. A barrel of crude oil holds 42 gallons. From this barrel will come about 12 gallons of diesel fuel, 4 gallons of jet fuel, and smaller amounts of propane, asphalt, motor oil, and various lubricants, along with about 19 gallons of gasoline. So it takes a barrel of oil, on average, to come up with about 1.5 tankfuls of gas in your average, non-diesel car.

Considering all the oil products, each person in the U.S. consumes an average of about 2.5 gallons of crude oil per day, according to the Department of Energy. As a result, the price of a barrel of oil affects each us beyond the pump, too.

The price of oil has been a major economic factor for years. The cost of energy affects virtually every aspect of the economy and the market, including our investments.

The supply of oil will eventually increase, especially as new producers come online and oil-producing countries change their plans.

Your financial advisor will monitor all of these developments and is best source for information about their effect on your investments.

With so much going on in the world these days, it's easy to overlook the developments in the precious metal markets. Even as governments continue to devalue currencies, central banks across the globe have been accumulating gold. Should investors start considering a small allocation in precious metals as well?

How much you should invest in precious metals, of course, depends on your portfolio and other factors.

In the current global economic environment, precious metals might look like a good short term-investment. Simply put, precious metals may be a good hedge for investors facing the myriad of problems associated with the present economic environment, especially raging inflation.

Many will suggest that a diversified portfolio of tangible assets such as gold or silver could equal about 5% (and sometimes more) of your portfolio. And it’s hard to argue against that being considered a prudent asset-diversification strategy. That is especially true in today's uncertain political and economic environment, there are many (and very sound) reasons to consider investing in precious metals to diversify your holdings.

But keep in mind, precious metals are not like other asset allocations. For example, putting money in precious metals is very different than investing in the stock market.

Even the word "investment" seems a bit out of place here. Gold doesn't pay dividends; gold doesn't pay interest. It's a metal that has historically been used as money. Throughout the world, gold continues to be recognized as money.

As such, it can offer long-term protection as currency is devalued for investors looking to be able to maintain their lifestyles 20 to 30 years down the road.

Most have often wondered about the answer. The answer may not be "absolutely nothing," as in the Edwin Starr song, but it is a lot less than you might think.

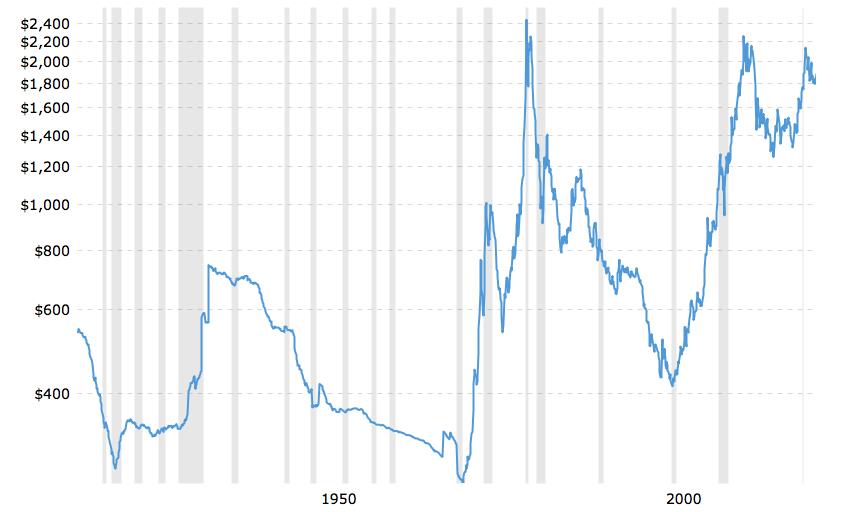

The yellow metal has reacted meaningfully during only two incidents in the 44 years since Nixon closed the gold window on August 15, 1971: the 1970s inflation/oil crisis and the 2000s rise of China/financial crisis/debt deflation.

If you looked at a 100+ year historical chart depicting the price of gold, you’d realize that there were really just two significant spikes in the gold price.

The first occurred at the end of the 1970s. It followed the great inflation and two oil shocks and dissipated in the wake of Volcker’s tightening of monetary policy.

Spike two came with the rise of China and the run up of commodity prices in its wake. It continued into the financial crisis. So, gold could have provided a counterbalance to your portfolio during two ugly incidents in financial markets. What about the myriad other crises we have been through over the past four decades?

What did gold do during:

The answer is precisely nothing.

Gold has done well when safe assets, like US treasuries, offer negative real returns. It is only at such times that an asset which earns nothing and may cost you (or the ETF provider) something to store is worth holding.

We are beyond the Fed starting to move away from its zero interest rate policy – that started a while ago. Remember, the all-time low was 0.25 percent, which is effectively zero.

Real rates are likely to be higher across the curve over the next few years. That has turned gold into just another commodity; it will likely remain that way for many years. Someday, when the imbalances have added up and policy makers misjudge events, gold will once again have a moment in the sun.

At best, gold is a useful tactical asset in situations where returns on safe assets turn negative. Those incidents have been relatively rare.

Gold should probably not be a perennial in your portfolio if you live in a place with developed financial markets and the rule of law. It earns no income and serves little purpose.

Strong Valley is pleased to support the Clovis FFA, with its long tradition of excellence in Agriculture, Leadership and Citizenship. We brought together a table of clients to attend the recent FFA Booster Club Fundraiser Dinner and had a wonderful evening of celebrating this noteworthy local program.

The Clovis FFA Booster Club is an organization benefiting the members of the FFA. The club provides funding to assist students involved in many different activities and provides many of our seniors with scholarships.

The Mission of Clovis High School is to ensure that all students will be given every opportunity to maximize their potential in the areas of Mind, Body, and Spirit, enabling them to become productive, contributing members of our society. The Vision of Clovis High School is to connect today's students to tomorrow's opportunities.

The Clovis FFA was established in 1932 and has one of the top Agriculture Education programs in the State of California, along with the best high school agriculture facility.

Here is a statement that is bound to cause you to raise your eyebrows: Your long-term financial success depends less on the structure of your portfolio than on your ability to adapt your behavior to changing economic times.

At the very foundation of your financial well-being lies your behavior. In fact, one can plausibly argue that the dominate determinants of long term, real life, investment returns are not market behavior, but investment behavior.

Look at it this way: most of us would agree that, while meticulously constructed investment portfolios can probably weather almost any economic storm, none can withstand the fatal blow of an owner who panics and sells out.

So prevalent is such panic that an entire field – behavioral finance – studies how and why investors like you might make dumb money moves.

An increasing number of financial planners realize that their primary business isn’t just producing your financial plan or furnishing you with investment advice but caring for and transforming your emotional well-being.

In many respects, financial advisors are the antidote to investors’ panic. In theory, all financial advisors will try everything to keep a client from turning a temporary decline into a permanent loss.

But the tendency to sell low and buy high will not stop anytime soon – and it’s in all of us.

Supporting your financial and emotional well-being often requires that both you and your advisor learn from each other and work together over the long term. You both also must realize that antidotes to panic sometimes require more than one dose.

When managing personal finances and investments, people frequently exhibit irrational behavior for different reasons. If you’re one of these folks, be fair to yourself. It doesn’t even take a spate of market zigzags like what we saw in January of 2022 to prod you into questionable decisions.

Everyone makes choices about money nearly every day – how to earn, spend, save, invest and so on. Sometimes you pick wisely, sometimes harmfully. Some decisions, particularly those regarding when and where to invest, whipsaw from wise to harmful and back depending on when you reached your conclusion and when you took the plunge.

Supposedly, if you can learn more about the cause and effect of your money decisions, and what around you contributes to them, you will improve your financial security. Pinpointing behaviors as either rational or irrational in the middle of the storm comes hard though. The January 2022 market provided a convenient and timely case study to help explain why.

That month, the Standard & Poor’s 500 Index declined 5.3% and NASDAQ dropped 9.0%. If sensitive to market moves, maybe you are reading the declines and ready to sell – a flight that might be shown as irrational a few years from now.

If you wanted to sell after January’s declines you likely have loss aversion – one of many often-irrational money behaviors. Psychologically, people perceive losses (or declines in value of an investment) as much as 2½ times more impactful than gains of a similar size. Watch your investment drop $1,000 and you feel more than twice as bad as you might feel good about a gain of $1,000.

Most people are loss averse and it’s clear why many sell when market prices decline. Is loss aversion irrational? Or sometimes is it timely clairvoyance?

Let’s go back to the start of the pandemic. Let’s say you eliminated your market exposure on the same exact day that the CDC confirmed its first case of COVID on January 20th. And then you jumped back into the market exactly two months later, on March 20th.

Instead of irrational, you would have appeared brilliant. Because although January 20th was not precisely the high (it was February 14th, but you were really close), March 20th was exactly the bottom.

What-if situations such as these clearly show that sometimes irrational behavior produces good outcomes. But more often than not, well-trained (and often self-proclaimed) experts applying rational processes to money management wind up on the wrong side of the intended outcome, especially in the short term. This helps make investing fascinating and, at times, maddening.

Because investment markets are complex and potentially both irrational and efficient, understand well your tolerance for risk. Define what risk actually means in terms of your financial security and your willpower to handle markets when fear and greed influence decisions.

A written investment strategy can serve as a foundation for your long-term decisions. Your strategy – and your commitment – may also benefit from testing your strategy’s performance hypothetically in past crises.

Since we can’t predict outcomes that depend partially on luck, we plan according to probabilities. For example, rather than focus on the size of your expected returns, know the probability that your investment strategy can support your desired spending rate in retirement or make tuition payments, fund a wedding, cover health-care costs and so on. Your broader financial plan drives your investment strategy not the other way around.

Ideally, when your goals link directly to your plan you have a better foundation for dealing with investment uncertainty and Wall Street’s effect on your emotions and decisions.

Strong Valley Wealth & Pension is proud to be a supporter of Clovis High School Cougar Baseball. We are donating the following package to help kickstart a great 2022. Go Cougars!

Primary contact for this auction item – Chris Conner (559) 384-2400 or chris@adamstrongvalley-com