You are now leaving the Strong Valley Wealth & Pension, LLC ("Strong Valley") website. By clicking on the "Schwab Alliance Access" link below you will be entering the Charles Schwab & Co., Inc. (“Schwab”) Website. Schwab is a registered broker-dealer, and is not affiliated with Strong Valley or any advisor(s) whose name(s) appears on this Website. Strong Valley is/are independently owned and operated. Schwab neither endorses nor recommends Strong Valley. Regardless of any referral or recommendation, Schwab does not endorse or recommend the investment strategy of any advisor. Schwab has agreements with Strong Valley under which Schwab provides Strong Valley with services related to your account. Schwab does not review the Strong Valley website(s), and makes no representation regarding the content of the Website(s). The information contained in the Strong Valley website should not be considered to be either a recommendation by Schwab or a solicitation of any offer to purchase or sell any securities.

Valentine’s Day is of course an extremely popular day for marriage proposals. Regardless of which side of the engagement you’re on – or when your engagement occurred – consider how, when and where to wed not just each other, but also your finances.

Fights about money constitute one of the biggest frictions in marriage. While everyone sees financial well-being differently, you can minimize that potential friction many ways.

You would be surprised at how many people don’t discuss finances with life partners. While some simply prefer not to talk about money, others just don’t know how to go about it.

As with other parts of your relationship, keeping the financial lines of communication open is essential for success. An ongoing financial check-up appearing regularly on your calendar – weekly, weekly, monthly or even semi-annually – makes a great way to touch base on current money affairs. Call it your “financial roundtable.”

Sit down and discuss your financial situation, and identify short-term and long-term goals. Developing a clear understanding of where you are financially and where you want to be – in a month, in five years, anytime in the future – goes a long way toward ensuring that both of you work toward the same goals. Not to mention that it minimizes any miscommunication regarding everyday spending and saving.

Perhaps your idea of saving and your contributions to retirement plans and similar accounts differ from your partner’s. But putting a plan together on how to budget expenses and save for common goals reduces misunderstandings and, in turn, conflicts over money.

Creating a family budget (perhaps an eye-opening task for somebody who’s formerly single) starts with aggregating your incomes and writing down every possible expense, including savings and allowance for miscellaneous costs you don’t expect. Whether you allocate $10 or $1,000 to monthly savings as a start, the important thing is that you save and grow those contributions together.

Also, if you have big plans such as a (somebody else’s) wedding, a vacation or a new baby, you can create an additional savings account for that purpose. This allows you to avoid dipping into your core savings.

As you might soon learn from your new life mate, not everyone is born with a knack for managing finances. Even those who clearly understand what needs to be done regarding money are often too busy focusing on other important parts of life, such as making a living, taking care of kids, preserving good health or having a social life.

The good news: your financial advisor can offer technology that can help with personal finances, from mobile banking to organizing your cash flow. You no longer need to invest significant time and energy in understanding your current financial well-being.

Sure, it’s a lot easier to ignore your personal finances then tackle them head on. But as you plan to share your life with someone, set yourself up for success from the very beginning. The more you communicate and work for the same financial goals, the greater the chance for a happy union personally and financially.

Happy Valentine’s Day.

Lately it seems as if every client or potential client asks about the possibility of a looming market correction. Investors love good times, but they're smart -- they know the market runs in cycles, and the good times can't last forever. We're in the second-longest bull run in history. And yet there's uncertainty, too, globally and in this country. When people ask if a correction is coming and what they should do to prepare, the best answer for most is: stay the course.

Whether you're still working or already retired, consistency pays off. Especially in uncertain times, when a market correction is on many people's minds, it may be best to stick to your plan. If you don't, if you overreact, you could end up making financial decisions that may set you back in your strategy.

Of course, if you're worried that the plan you have in place is not the best, that's a different conversation. Then it may make sense to make some changes. If that's the case, here are a few steps to consider:

Perhaps you've been handling things just fine on your own with your 401(k) or 403(b). As you near retirement, however, it's time to speak to a specialist who can help you take the focus from accumulation and growth and put it on income planning and asset protection.

Many financial professionals will consult with a potential client once or twice with no obligation, so you can get a feel for whether you're a good fit. You should ask for an analysis to see if there are any redundancies in your current portfolio, if you are truly diversified and if you are paying any unnecessary fees.

You also should talk about risk -- how much you can stomach emotionally, how much you can afford and how much is in your current portfolio. Your financial professional has resources to help assess and align your risk. That is especially important if you're anticipating a market downturn and might be tempted to make trades based on your anxiety.

A lot of people have piles of statements from different accounts, but that doesn't always mean they have a strategy in place. In retirement, you need a detailed plan for your money -- and that plan should help give you more confidence that you'll be OK.

People tend to get out of the market when it's down, and by then they may have already lost money. Then they may get back in when it's coming around again . . . but by then, most of the gains could already have been made. That bad timing can be very costly.

Everyone is talking about a coming correction, but what exactly does that mean? It isn't the same as a pullback -- typically defined as a short-term decline of 5% to 9% from a recent high. And it isn't as menacing as a bear market, which is a downturn of 20% or more that can last for months.

A correction is the middle ground -- a 10% to 19% drop from recent highs. It's a little scarier than a pullback, but it's still temporary. It is sometimes an indicator that we're going to have a bear market, but that's not always the case. It can be an opportunity for investors hoping to get discounted prices. Unfortunately, it's also when some people go wrong based on their emotions. Fight the instinct to flee.

The old-school equation for diversification is a 60-40 split between equities and bonds -- and that's not always a bad scenario. But these days, there are so many more options, both for protection and growth.

If interest rates continue to rise, it could have a ripple effect, and the bond market likely will suffer. In retirement, that may not help you as an inflation hedge, so it's important to look at alternatives such as annuities. A good annuity can be a valuable piece of your plan. It's a long-term financial vehicle -- the insurance company gets to use your money for a pre-determined number of years -- but that's not a bad thing for someone who is 60 years old. Annuities aren't for everyone, though, so ask your financial professional if they would be a fit for you.

If you're ready to make a change or create your first real retirement plan, find a financial professional who is focused on informing and enabling you, not selling you products. And be careful about what you read and hear. It's good to have information, but what you see in the media isn't necessarily tailored to your specific needs. Find a financial professional who is focused on assessing your individual situation.

An experienced and knowledgeable financial professional can help equip you to work toward your goals -- while considering uncertainty in the market.

Let’s be honest for a second: the DJIA, the S&P 500, NASDAQ and the Russell 2000 all delivered one of the most surprising years in recent history. And while many are happy to see 2021 in the rear-view mirror, the 2021 performance for the major U.S. indices was nothing short of impressive, especially given the headwinds of COVID-19.

Who could have predicted that:

As we enter 2022, there will be no shortage of talking-heads trying to scare investors that we might be in a stock market bubble. And they might be right.

But the flip-side is that there are just as many talking-heads suggesting that stock markets still have plenty of room to grow, and that this time it really is different. The reality is that it’s a topic that divides some of the brightest minds in finance.

So, rather than jump down that rabbit hole, let’s instead listen to what the stock markets are telling us. Are trends developing that might shape the next few years? Has COVID-19 forever shifted the landscape of some industries at the expense of others?

Maybe 2021’s 5 best- and worst-performing stocks from the DJIA and S&P 500 (and the best performer from the S&P 400 Mid Cap Index) can inform?

Within the 30-stock DJIA, 2021 saw 25 record positive performance and the gap between the best and the worst performer was wide.

| Company | 2021 Total Return |

| Home Depot | +59.5% |

| Microsoft Corporation | +52.5% |

| Goldman Sachs Group | +47.6% |

| Chevron Corp. | +46.3% |

| Cisco Systems | +45.8% |

| Honeywell International | -0.3% |

| Visa Inc. Class A | -0.3% |

| Boeing Co. | -6.0% |

| Verizon Communications | -7.5% |

| Walt Disney | -14.5% |

The S&P 500 is weighted by market capitalization and the five largest companies – Apple, Microsoft, Amazon, Alphabet (Google) and Tesla – make up 23% of the Index as of December 31st. That being said, the gains for S&P 500 companies were plentiful in 2021, with 88% of companies in the S&P 500 ending the year in positive territory.

Among the top 20 best-performers in the S&P 500, the top 2 and 6 of the top 20 were oil producers and that in itself speaks volumes. And last year’s top stock Tesla was “only” up 49.8% this year – a far cry from 2020’s eye-popping 743% return.

But as the table below demonstrates, the gap between the best and the worst performers in the S&P 500 was obscenely wide. Some might argue that the gap defies logic altogether.

| Company | 2021 Total Return |

| Devon Energy Corp. | 196.1% |

| Marathon Oil Corp. | 149.7% |

| Moderna Inc. | 143.1% |

| Fortinet | 142.0% |

| Signature Bank | 141.5% |

| MarketAxess | -26.9% |

| Activision Blizzard | -28.0% |

| Las Vegas Sands | -36.6% |

| Global Payments | -36.9% |

| Penn National Gaming | -42.9% |

Remember the GameStop craziness to start the year? Here’s a refresher: from January 1st through January 27th, shares of GameStop were up 1,744.5%. Then the stock took a dive.

But for those who held on all year, GameStop shares were up 687.6% for 2021, on its way to becoming the top performer among companies in the S&P 400 Mid Cap Index. Kind of crazy.

The answer to that question is, of course, very personal. And depending on your perspective, your course of action will be personal too. But as your financial advisor, I would encourage you to think beyond just investing.

Think about things like:

Finally, if you are thinking of altering your asset allocations due to what you think might be longer-term trends, let’s discuss.

*Source for tables: Yahoo Finance

There is a lot of speculation going on in the news lately about the feds raising the interest rates in 2022 or 2023. Whether you are a lender, a borrower or both, carefully consider how interest rates may affect your financial decisions.

When discussing bank accounts, investments, loans, and mortgages, it is important to understand the concept of interest rates. Interest is the price you pay for the temporary use of someone else’s funds; an interest rate is the percentage of a borrowed amount that is attributable to interest.

Although borrowing money can help you accomplish a variety of financial goals, the cost of borrowing is interest. When you take out a loan, you receive a lump sum of money up front and are obligated to pay it back over time, generally with interest. Due to the interest charges, you end up owing more than you actually borrowed. The trade-off, however, is that you receive the funds you need to achieve your goal, such as buying a house, obtaining a college education, or starting a business. Given the extra cost of interest, which can add up significantly over time, be sure that any debt you assume is affordable and worth the expense over the long term.

To a lender, interest represents compensation for the service and risk of lending money. In addition to giving up the opportunity to spend the money right away, a lender assumes certain risks. One obvious risk is that the borrower will not pay back the loan in a timely manner, if ever. Inflation creates another risk. Typically, prices tend to rise over time; therefore, goods and services will likely cost more by the time a lender is paid back. In effect, the future spending power of the money borrowed is reduced by inflation because more dollars are needed to purchase the same amount of goods and services. Interest paid on a loan helps to cushion the effects of inflation for the lender.

Interest rates often fluctuate, according to the supply and demand of credit, which is the money available to be loaned and borrowed. In general, one person’s financial habits, such as carrying a loan or saving money in fixed-interest accounts, will not affect the amount of credit available to borrowers enough to change interest rates. However, an overall trend in consumer banking, investing, and debt can have an effect on interest rates. Businesses, governments, and foreign entities also impact the supply and demand of credit according to their lending and borrowing patterns. An increase in the supply of credit, often associated with a decrease in demand for credit, tends to lower interest rates. Conversely, a decrease in supply of credit, often coupled with an increase in demand for it, tends to raise interest rates.

As a part of the U.S. government’s monetary policy, the Federal Reserve Board (the Fed) manipulates interest rates in an effort to control money and credit conditions in the economy. Consequently, lenders and borrowers can look to the Fed for an indication of how interest rates may change in the future.

In order to influence the economy, the Fed buys or sells previously issued government securities, which affects the Federal funds rate. This is the interest rate that institutions charge each other for very short-term loans, as well as the interest rate banks use for commercial lending. For example, when the Fed sells securities, money from banks is used for these transactions; this lowers the amount available for lending, which raises interest rates.

By contrast, when the Fed buys government securities, banks are left with more money than is needed for lending; this increase in the supply of credit, in turn, lowers interest rates. Lower interest rates tend to make it easier for individuals to borrow. Since less money is spent on interest, more funds may be available to spend on other goods and services. Higher interest rates are often an incentive for individuals to save and invest, in order to take advantage of the greater amount of interest to be earned.

As a lender or borrower, it is important to understand how changing interest rates may affect your saving or borrowing habits. This knowledge can help with your decision-making as you pursue your financial objectives.

As a busy executive or business owner, your personal financial and estate planning needs may be different from other individuals. Your current compensation package probably contains a variety of benefits, some of which may not be portable. Some benefits may also place restrictions on present enjoyment, while other benefits may become available only upon retirement or death.

Because much of your estate may be tied up in the stock of your company, you may have liquidity problems. In addition to business concerns, personal finance requires careful planning. You may need to plan for children who need or will need educating, often in private schools, long before applications are made to expensive colleges and universities. Or, you may already have a child in college or graduate school.

Juggling the responsibilities of your business and your personal affairs is a challenging task. However, it’s important to take some time out of your busy schedule to review your personal financial plan. Here are a few simple suggestions to help you keep your personal finances on firm ground:

Make a commitment now to put your personal planning process in motion. Call today and make an appointment with your Financial Planner. They have the experience, resources and strategic partnerships to help you pull together all of these needs in your personal finances, freeing you up to focus on your business.

Sometimes it’s hard to tell if you need professional help for a problem or if you can handle it yourself. Whether it’s taking care of a common cold, fixing the sink, changing the oil in your car or doing your own taxes. The same question often arises about finances.

It happens all the time - financial questions pop up that you consider silly or stupid so you feel like you must handle alone and you don’t seek help. This is not the best course. As happens often in life, not reaching out to a professional can delay you reaching your goals and cause you to incur more out-of-pocket expenses and lots of headaches.

Here is the thing: there are no stupid questions when it comes to your finances. Don’t ever sit on the sidelines and fear asking a question or think you’re unqualified to go to a planner. Solid and respectable planners let you know if they can’t help you and refer a professional who can. They also let you know if they think you can plan your finances yourself.

Here are signs you may need a financial planner:

To merge or not to merge finances is a huge question: emotions to contend with, forms to update, cash flow to track, debts to pay down, goals to lay out and spending habits and needs to reorganize and prioritize.

Communication during this transition helps you navigate possible questions about taxes, investment allocation updates, selecting benefits, joint roles in management of the household, deciding whether to maintain separate bank accounts and more.

Whether considering starting your own business or a long-term entrepreneur, you likely need to know how to prioritize goals, pay yourself while keeping the operation running and the best way to manage cash flow on an income that fluctuates monthly.

Not to mention saving for retirement, obtaining health insurance and protecting you and your family against a loss in income from death or disability.

Simple budgeting often enables you to handle large purchases. If you look to buy a first home or make another sizeable investment, understanding the overall effect on your cash flow, lifestyle and future goals looms large.

How much home can you afford? What’s your budget for home maintenance? What other goals go on the back burner? What about your future savings?

Job or career transitions also bring changes in income and benefits. Make sure you maximize your company benefits, leave no retirement accounts behind and ignored, plan appropriately for income fluctuations, take into account future job growth or career prospects and consider the transition’s overall influence on your lifestyle.

A baby comes with a slew of considerations: ensuring you have an emergency fund of three to six months’ expenses adjusting your spending for child care, groceries and medical costs and updating your estate plan and insurance coverage in case something happens to you, among many other needed updates.

The first step in asking for help always seems the hardest. The assistance and feedback may surprise you when you open up to the idea that you need not handle all financial questions solo.

And it makes the experience much more enjoyable.

They say appearances can be deceiving. In the case of gift giving, they might be right.

Consumers in the U.S. spend billions of dollars a year on wrapping gifts, in most cases to make their presents look as good as possible. This includes money spent on paper, boxes, ribbon and pretty bows.

While some people are particularly skilled at gift wrapping – with the perfect folds, carefully tied ribbons and bows – others aren’t quite cut out for it, and apparently would prefer washing dishes or cleaning the house.

Two colleagues and I wondered whether all that time and effort is actually worth it. Does a beautiful presentation actually lead to a better-liked gift? Or is it the other way around?

In a paper recently published by the Journal of Consumer Psychology, University of Nevada, Reno professors Jessica Rixom and Brett Rixom and I conducted three experiments to explore the impact of gift wrapping.

In the first experiment, we recruited 180 university students to come to a behavioral lab in Miami to participate in a research study described as an extra credit exercise. Upon arrival, each student was given an actual gift as a token of appreciation for their participation.

The gift was a coffee mug with the logo of one of two NBA basketball teams, the local Miami Heat or rival Orlando Magic, handed out at random. We knew that every participant was a fan of the Heat based on a prior survey – and that they explicitly didn’t support the Magic. The purpose was to ensure that we were giving half of the students a desirable gift, while the other half received something they did not want.

Finally, half of the gifts were wrapped neatly, while the rest looked slapdash.

After unwrapping, participants evaluated how much they liked their gifts. We found that those who received a sloppily wrapped gift liked their present significantly more than those who received a neatly wrapped gift – regardless of which mug they got.

To understand why, we recruited another set of students and asked them to view an image of either a neatly or sloppily wrapped gift and report their expectations about it prior to seeing what was inside.

Participants were then told to imagine opening the gift – which for everyone was a pair of JVC earbuds – and rate their actual attitudes toward it, allowing us to compare whether it matched their expectations or not.

Results showed that expectations were significantly higher for the neatly wrapped gifts compared with sloppily wrapped ones. However, after the reveal, participants receiving the neatly wrapped gift reported that it failed to live up to their expectations, while those who got the sloppily wrapped gift said it surpassed their expectations.

This suggests that people use the wrapping as a cue to how good the gift will be. Neat wrapping sets the bar for the gift too high, intimating that it will be a great present. Sloppy wrapping, on the other hand, sets low expectations, suggesting it’ll be a bad gift.

So a sloppily wrapped gift leads to pleasant surprise, while one that’s neat-looking results in disappointment.

In our third and final experiment, we wanted to zero in on whether this effect depended on the relationship between the gift-giver and recipient. Does it matter if the giver is a close friend or just an acquaintance?

We surveyed a nationally representative sample of 261 adults and asked them to imagine being at a party with a secret gift exchange. At random, participants viewed images and imagined receiving either a neatly or sloppily wrapped gift. This time, we instructed half of them to imagine the gift was from a close friend, while the other half believed it came from an acquaintance. Then we revealed the gift and asked them to rate it.

When it came from a close friend, recipients ended up liking the sloppily wrapped gift more, just like in our other experiments. However, when the gift came from an acquaintance, recipients preferred it when it was neatly wrapped. This occurs because these participants used the wrapping as a cue to how much the gift-giver values their relationship – rather than to signal what’s inside. Neat wrapping implies the giver values their relationship.

So if you’re stressing over gift wrapping this holiday season, consider saving yourself time, effort and money by wrapping your friends’ and family’s gifts haphazardly.

But if you’re planning to give a gift to someone you don’t know quite as well – a work colleague, for example – it’s probably worth it to show you put in some effort to make it look good with all of the neat folds, crisp edges and beautiful bows.

I, for one, am taking these results to heart. From now on, I’ll only wrap my wife’s gifts sloppily so she’ll always be pleasantly surprised no matter how good – or bad – the gift is.

As stock markets continue to reach new highs, we’re bombarded with economic data that seemingly points to why the markets will continue their march forward – or why they will retreat this fall. Consider some recent data-headlines:

While much of this economic data can prove useful as guideposts to your investing plans, wouldn’t it be more useful if the data was specific to you?

For example, do you care (as much) that average housing prices have jumped double-digits over the past year if you have no intention of moving for another 10 years? Probably not.

Maybe it would be more helpful to receive macroeconomic data through your personal filters, so you could use that data to inform your investing decisions and retirement planning?

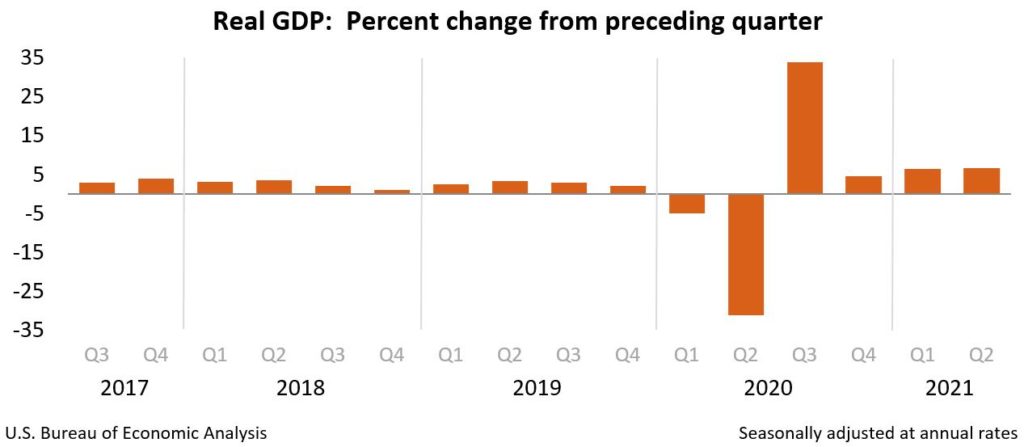

On August 26th, the Bureau of Economic Analysis reported that real gross domestic product (GDP) increased at an annual rate of 6.6% in the second quarter of 2021. But do you truly know what that “real GDP” means?

In very simple terms, the GDP of a country is an estimate of the total value of all the goods and services it produced during a specific period, usually a quarter or a year. It can be calculated by adding up all of the money spent by consumers, businesses, and government in a certain period (it may also be calculated by adding up all of the money received by all the participants in the economy). That number is called "nominal GDP" and once adjusted to remove any effects due to inflation, then we have the "real GDP.”

The real GDP is a number followed closely by Wall Street and economists as it represents a very broad measure of our country’s overall production and serves as a very comprehensive metric of the overall economic health of our country.

But seeing that GDP for the second quarter stood at $22.7 trillion might not be as useful to most of us, so it is often best used as a point of comparison from previous periods.

In other words, did our nation’s economy grow or contract compared to the previous quarter or year? (Relative to the first quarter of the year, our economy grew more – 6.6% versus 6.3%).

While GDP is a useful measure of our nation’s economic health, have you considered calculating your household’s GDP?

Here is an explanation of the recent increase in GDP from the Bureau of Economic Analysis:

“The increase in real GDP in the second quarter reflected increases in personal consumption expenditures (PCE), nonresidential fixed investment, exports, and state and local government spending that were partly offset by decreases in private inventory investment, residential fixed investment, and federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The increase in PCE reflected increases in services (led by food services and accommodations) and goods (led by "other" nondurable goods, notably pharmaceutical products, as well as clothing and footwear). The increase in nonresidential fixed investment reflected increases in intellectual property products (led by research and development as well as software) and equipment (led by transportation equipment). The increase in exports reflected an increase in goods (led by nonautomotive capital goods) and services (led by travel). The decrease in private inventory investment was led by a decrease in retail trade inventories. The decrease in federal government spending primarily reflected a decrease in nondefense spending on intermediate goods and services. In the second quarter, nondefense services decreased as the processing and administration of Paycheck Protection Program loan applications by banks on behalf of the federal government declined.”

Calculating your household’s GDP on a quarterly or yearly basis – and comparing it to the previous quarter or year – might be a useful exercise for you to determine the economic health of your household.

It would surely be useful as you think through your retirement goals and plans.